10 Most Luxurious Fabrics in the World

Explore the world’s most luxurious fabrics, known for their rarity, craftsmanship, and timeless elegance.

10 Refreshing Detox Drinks to Try This Summer

Beat the heat with these 10 detox drinks made with natural ingredients to refresh, cleanse, and energize your body!

Top 10 Marine Animals With Extraordinary Abilities

From deep-sea hunters to bio-luminescent creatures, these marine animals possess unique abilities that make them truly extraordinary.

Best Food to Eat for Sehri and Iftar

Fuel your Ramadan fast with nutritious Sehri meals and break it with energy-boosting Iftar delights for a healthy balance.

Top 10 Former Adult Stars Who Became Mainstream Actresses

These former adult film stars successfully transitioned into Hollywood, proving their talent beyond the adult industry.

Best Looks from the 2025 Oscars After-Party

The 2025 Oscars after-party was a star-studded fashion affair, with Demi Moore, Kim Kardashian, and Doja Cat leading the way.

Top 10 Stunning Red Carpet Looks at Oscars 2025

From shimmering couture to vintage classics, here are the top 10 jaw-dropping red carpet looks at the 2025 Oscars.

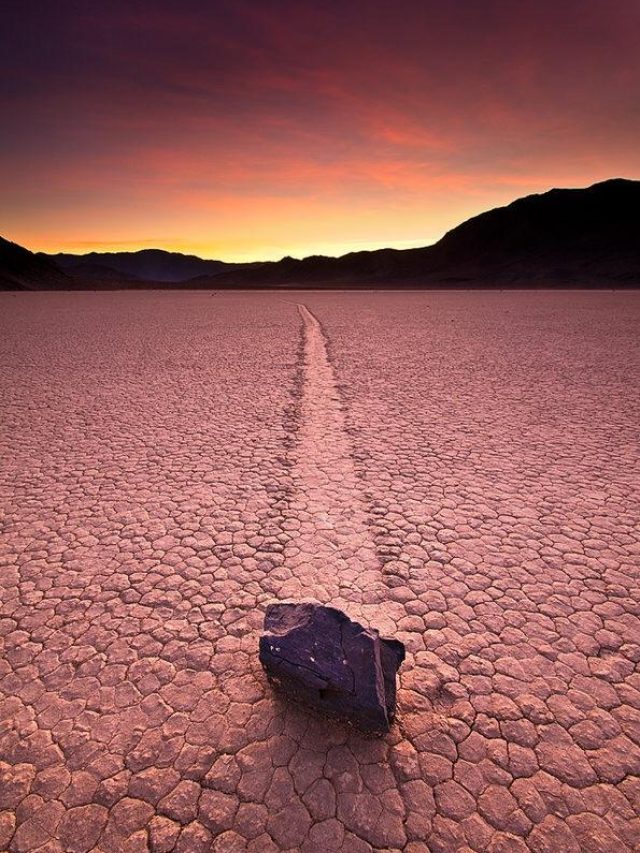

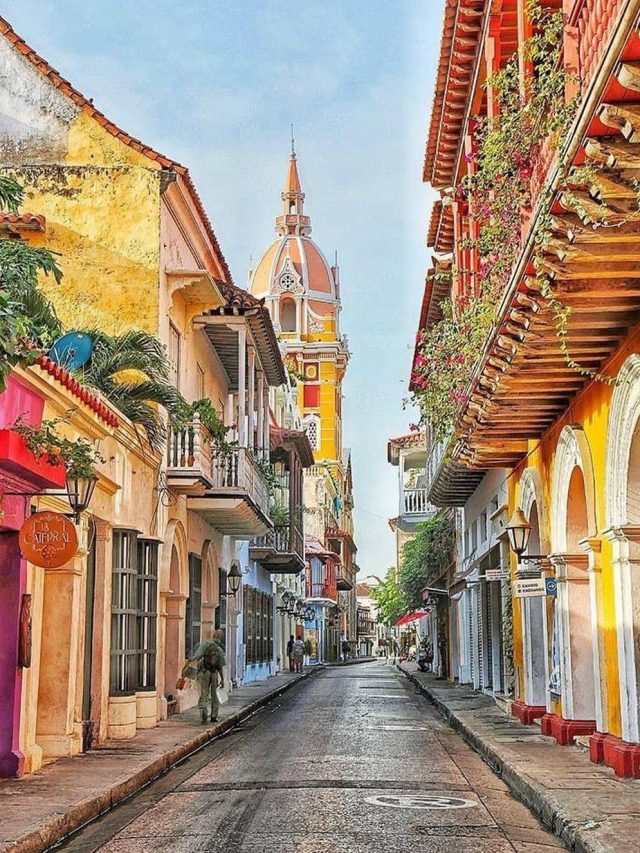

Top 10 Mysterious Places on Earth

From eerie landscapes to unexplained phenomena, these mysterious places continue to baffle scientists and explorers alike.

Top 10 Unique Beaches in the World

From glowing shores to pink sands, these breathtaking beaches offer one-of-a-kind experiences across the globe.

Different Types of Bags to Elevate Your Look

The right bag can transform any outfit. Discover 10 stylish bags that add elegance, function, and charm to your look.

Best Decorative Pieces That Bring Peace to Your Home

Create a serene and peaceful home with these decorative pieces that promote relaxation, mindfulness, and positive energy.

Best Luxury Home Decor Items for a Sophisticated Lifestyle

Elevate your living space with these luxurious home decor items that bring elegance, comfort, and sophistication to your home.

Healthy Junk Foods You Can Enjoy Guilt-Free

Not all junk food is bad! Some treats can be surprisingly nutritious when consumed in moderation.

Exercises to Improve Your Sex Life

Enhance your flexibility, stamina, and confidence with these exercises designed to boost your intimacy and pleasure.

Pisces Facts You Should Know About This Sign

Discover the unique traits of Pisces—compassionate, intuitive, and deeply emotional, making them one of the most mysterious zodiac signs.

Head-Turning Outfit Ideas for Girls at Work

Stay stylish and confident at work with these trendy yet professional outfit ideas that make a lasting impression.

Confessions to Make Your Partner Smile on Confess Day

Make Confess Day special by sharing heartfelt feelings, dreams, and promises with your partner to strengthen your bond.

Aquarius: 10 Fascinating Facts You Should Know

Independent and innovative, Aquarius is the zodiac’s visionary, known for intellect, originality, and deep humanitarian values.

Celebrate Flirt Day in Fun and Playful Ways

Flirt Day is all about playful charm and lighthearted romance! Here’s how to make it fun and unforgettable.

With Whom to Celebrate Flirt Day to Make It Fun

Flirt Day is for playful romance and lighthearted fun! Celebrate with these special people and make the day exciting.

Perfume Day: Different Notes for Different Moods

Set the perfect mood with the right fragrance! Explore perfume notes that match your emotions and elevate every moment.

Best Necklace Jewelry to Wear for Every Occasion

Enhance your style with the perfect necklace! From timeless classics to trendy pieces, discover must-have jewelry options.

Capricorn: Important Facts You Should Know

Capricorns are ambitious, disciplined, and loyal. Discover 10 amazing facts about this determined and practical zodiac sign.

Sagittarius: Important Facts You Need to Know

Sagittarius, the fiery adventurer, is known for its optimism, love for freedom, and honesty. Here are 10 amazing facts!

10 Heartfelt Promises to Make on Promise Day

Strengthen your bond this Promise Day with these meaningful commitments that show love, trust, and dedication to your partner.

10 Adorable Gifts to Surprise Your Girlfriend on Teddy Day

Surprise your girlfriend on Teddy Day with these 10 adorable and thoughtful toy gifts that will melt her heart!

10 Romantic Ways to Gift Chocolates on Chocolate Day

Make Chocolate Day extra special with creative and romantic ways to surprise your loved one with delicious chocolates.

Facts About Scorpio You Should Know

Scorpios are mysterious, intense, and fiercely loyal. Discover 10 fascinating facts about this powerful zodiac sign.

10 Easy Homemade Chocolate Desserts & Sweets for Chocolate Day

Celebrate Chocolate Day with these 10 delicious homemade chocolate desserts and sweets, perfect for surprising your loved ones!

Different Ways to Propose Your Girlfriend on Propose Day with a Surprise

Make Propose Day unforgettable with creative surprises! From romantic getaways to heartfelt letters, here are 10 perfect ideas.

10 Best Quotes to Express Your Love on Valentine’s Day

Express your love this Valentine’s Day with these 10 romantic quotes that will melt your partner’s heart!

Types of Roses & Their Perfect Recipients for Rose Day

Celebrate Rose Day by choosing the right rose! Each color has a special meaning—know which one to gift and to whom.

10 Types of Lingerie for Every Woman

From babydolls to garter belts, explore 10 lingerie types that blend comfort, style, and sensuality for every occasion!

Best Sexy Red Dresses to Wear on Valentine’s Day

Turn heads this Valentine’s Day with these 10 sexy red dresses, from bodycon to lace, for the ultimate romantic look!

10 Sexy Gowns for a Hot and Glamorous Look

Discover 10 sexy gown styles—from backless to high-slit—perfect for creating a hot, glamorous, and unforgettable look!

Unique Face Shapes That Define Women’s Beauty

Explore 10 different face shapes—from oval to heart-shaped—and how they inspire unique beauty and confidence in every girl!

10 Fascinating Facts About the Libra Zodiac Sign

Explore 10 fascinating facts about Libras—from their love for beauty to their diplomatic nature. Balance is their superpower!

Trendy Haircuts Every Girl Will Love Today

From bold pixie cuts to chic curtain bangs, discover 10 trendy haircuts that bring out every girl’s unique personality and style!

Hottest Dresses Women Love for Stunning Looks

From Little Black Dresses to High-Slit Gowns, explore the 10 hottest dresses every woman needs to look stunning and confident!

10 Sexy Nightwear Styles for Every Mood

Explore the 10 types of sexy nightwear—from lace babydolls to sheer robes—for the perfect mix of elegance and allure.

Unique Jewellery Pieces for a Sexy Look

From chokers to body chains, explore 10 unique jewellery pieces that elevate your style for a sexy, confident look!

10 Stylish Swimwear Types for Every Occasion

Discover the 10 types of swimwear, from classic one-pieces to bold monokinis—style and functionality for every swimmer!

Explore Different Types of Wine and Flavors

Explore 10 types of wine, from reds to sparkling, their distinct flavors, and the perfect pairings to savor them.

10 Best Animated Films to Watch on Hotstar

Join the adventure with these 10 animated films on Hotstar, featuring timeless classics, epic quests, and unforgettable characters!

Virgo: 10 Fascinating Facts You Should Know

Virgos are perfectionists with sharp minds, caring hearts, and a knack for detail. Here are 10 amazing facts about them!

Maha Kumbh’s Viral Sensation Monalisa Bhonsle’s Rise to Fame

Monalisa Bhonsle, Maha Kumbh’s viral sensation, celebrates her birthday as her journey from garland seller to star inspires millions.

Leo – 10 Amazing Facts About the Fiery Zodiac Sign

Leos, ruled by the Sun, embody confidence, creativity, and loyalty, making them natural leaders and passionate achievers.

IIT Baba Abhay Singh – A Remarkable Journey from IIT to Spirituality

IITian Baba Abhay Singh’s journey from IIT Bombay to spirituality reflects a blend of science, art, and life’s purpose.

Types of Whiskey – 10 Distinct Varieties for Every Taste

Explore 10 whiskey types, from smoky Scotch to sweet Bourbon, and discover the unique flavors behind each variety!

10 Amazing Facts About Cancer

Cancer, the nurturing zodiac crab, is intuitive, emotional, and fiercely loyal. Explore 10 amazing facts about this loving sign!

Gemini – 10 Amazing Facts About the Zodiac Twin

Gemini, the zodiac twin, is a symbol of curiosity, wit, and charm. Dive into 10 fascinating facts about this versatile sign!

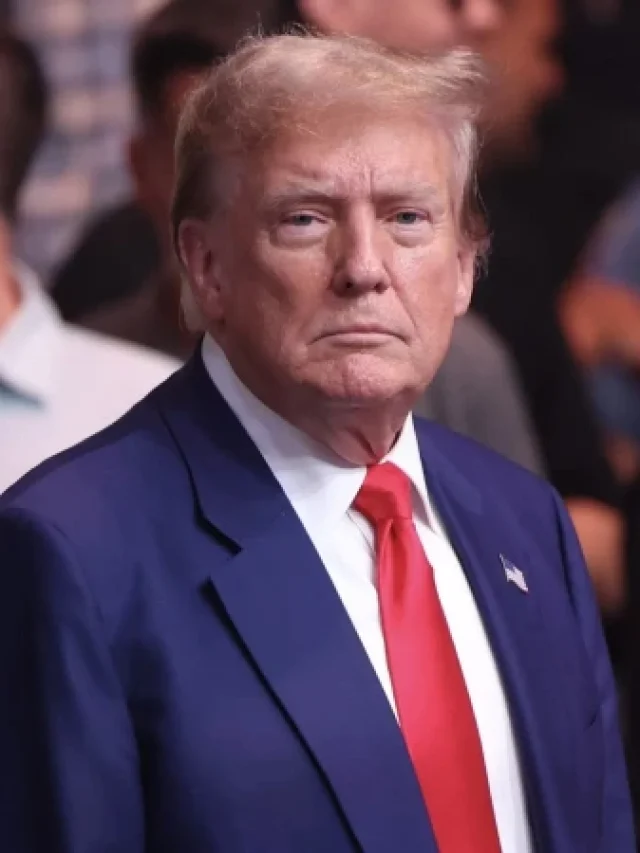

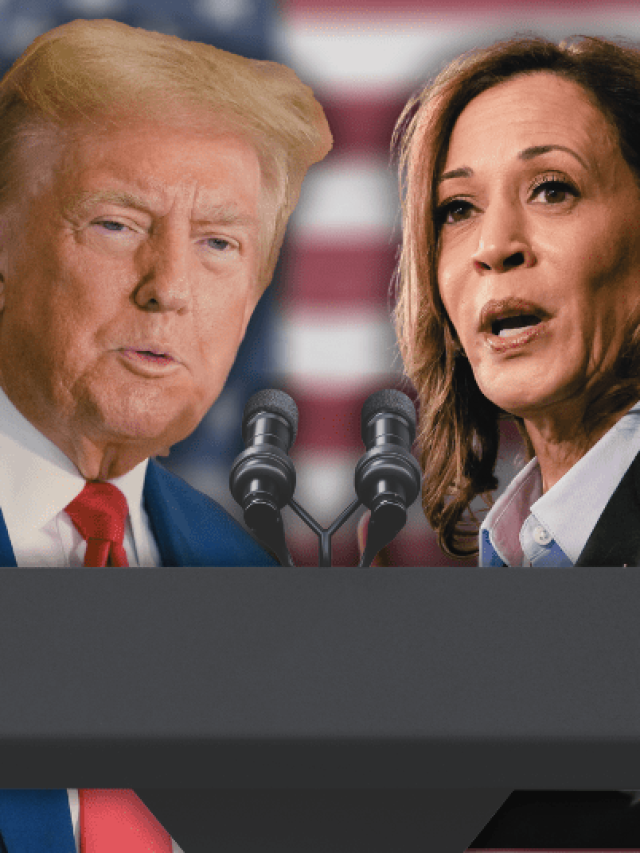

Donald Trump Inauguration – Key Highlights from Day One

Donald Trump Inauguration: Trump kicks off his second term with unprecedented executive actions, bold policies, and promises of unity and strength.

Trusted by Trump – Meet the 10 Key Figures Shaping His Vision

Trump’s appointees bring loyalty and bold reforms. From border security to global trade, they aim to deliver his vision.

Donald Trump’s Second Inauguration Highlights

Donald Trump returns as the 47th U.S. President. The inauguration showcases unity, tradition, and star-studded performances.

Taurus: Amazing Facts You Should Know

Discover the incredible traits of Taurus: the zodiac sign of loyalty, strength, and determination.

Best and Boldest Looks from the Golden Globes

A decade-spanning journey of unforgettable fashion moments at the Golden Globes, celebrating bold and iconic looks.

Saif Ali Khan Injured During Attempted Burglary at Mumbai Home

Saif Ali Khan sustains multiple stab wounds during a robbery attempt at his Mumbai residence. Emergency surgery underway.

BCCI’s New Strict Rules: Impact on Players and Families

BCCI imposes strict rules on player travel and family time to boost team unity after India’s poor cricket performance.

10 Amazing Facts About the Bold Zodiac

Aries, the zodiac’s bold leader, is full of energy, courage, and optimism, always ready to take on the world.

Celebrities Who Rocked Bold Naked Dresses on the Red Carpet

From Dua Lipa to Bella Hadid, celebs wowed in bold “naked dresses,” redefining red carpet fashion with daring looks.

What is Maha Kumbh? Its Meaning, Customs, and Beliefs Through the Ages

Maha Kumbh Mela is a divine convergence of faith, mythology, and culture, embodying India’s spiritual legacy through the ages.

Why You Should Wash Your Towels More Often

Towels are microbe magnets! Learn why frequent washing is crucial for hygiene and health.

Harsha Richhariya – The Viral Sadhvi at Maha Kumbh 2025

From glitz and glamour to spirituality, Harsha Richhariya’s journey as a Sadhvi at Maha Kumbh 2025 captivates netizens.

The Ongoing Debate on Work-Life Balance in India

Work-life balance remains essential, with 41% of Indian workers prioritizing wellbeing over promotions. The debate continues.

New Delhi-Srinagar Vande Bharat – A Game-Changer for Kashmir

Kashmir’s first direct New Delhi-Srinagar Vande Bharat train to launch, covering 800 km in under 13 hours.

Mahakumbh Mela 2025 – World’s Biggest Religious Gathering

400 million devotees unite at Maha Kumbh Mela 2025 in Prayagraj for purification and spiritual liberation, embracing tradition.

2025 Color Trends to Wear All Year

Explore 2025’s bold and refreshing color palette, from digital lavender to fiery red, shaping fashion all year long.

How to Choose Lipstick Color According to Skin Tone?

Find the perfect lipstick shade that complements your skin tone effortlessly with these 10 expert tips.

India’s Test Cricket Decline: Challenges and Hopes Ahead

India’s Test cricket supremacy faces a steep fall with recent losses, fading stars, and a team in transition.

LA Wildfires – A Crisis Fueled by Nature and Climate Change

Wildfires devastate Los Angeles, claiming lives, destroying homes, and forcing mass evacuations amid worsening climate impacts.

Rohit Sharma – Performance, Criticism, and Leadership

Rohit Sharma’s recent struggles with form have led to intense scrutiny. His frustration is understandable, but critique drives excellence.

Best Food to Try in Hobart

Explore Hobart’s culinary delights, from fresh seafood to artisanal sweets, showcasing Tasmania’s rich food culture.

Discover Your Horoscope’s Hidden Secrets

Unlock the mysteries of the zodiac! Explore how your horoscope shapes your personality, love, and future.

Best Dressed Stars at the 2025 Golden Globes

From Zendaya’s old Hollywood glamour to Miley Cyrus’ rockstar chic, these celebs stole the spotlight in iconic looks.

Stunning Celebrity Arrivals at the 2025 Golden Globes

Celebrities brought their fashion A-game to the 2025 Golden Globes, dazzling in iconic looks that set red carpets ablaze.

HMPV Cases Detected in Bengaluru – What You Need to Know

Bengaluru confirms 2 HMPV cases in infants. Govt assures no alarming trends in respiratory illnesses across India.

10 Cozy Slipper Types to Warm Your Winter

Keep your feet warm and stylish this winter with the coziest types of slippers and shoes for every

occasion.

10 Energizing Foods to Stay Full This Winter

Stay energized and warm this winter with these wholesome, filling foods that boost energy and keep hunger at bay.

Top 10 Luxury Brands Across Industries

Explore the world’s top luxury brands across fashion, tech, and more, redefining elegance and innovation.

10 Stylish Ways to Rock Snow Boots

Stay warm and stylish this winter! Discover 10 creative ways to rock snow boots for every snowy adventure.

Unforgettable Celebrity Fashion Moments That Defined 2024

From Old Hollywood glamour to futuristic fashion, 2024’s celebrity moments redefined style across red carpets and runways.

Must-See Sights in Cairns

Discover Cairns, a tropical haven in Australia offering world-class reefs, rainforests, cultural experiences, and natural wonders.

Growing Your Own Toilet Paper – A Green Alternative

Plectranthus barbatus, the “toilet paper plant,” offers a sustainable solution to deforestation and rising tissue costs, with global potential.

Wsparcie Muska i Ramaswamy’ego dla wiz H-1B wywołuje kontrowersje

Wezwanie Elona Muska i Viveka Ramaswamy’ego do rozszerzenia wiz H-1B wywołało ostrą debatę, odzwierciedlającą napięcia między innowacyjnością, polityką imigracyjną i lojalnością polityczną.

Jimmy Carter’s Legacy – A Life of Service, Faith & Humility

Jimmy Carter, a man of principles, faith, and humanitarian efforts, leaves behind an enduring legacy after passing at 100.

Dziedzictwo Jimmy’ego Cartera — życie pełne służby, wiary i pokory

Jimmy Carter, człowiek zasad, wiary i wysiłków humanitarnych, pozostawia po sobie trwałe dziedzictwo po śmierci w wieku 100 lat.

Stanowisko Trumpa w sprawie wiz H-1B wywołuje debatę

Trump popiera wizy H-1B, wywołując debaty. Elon Musk broni ich wpływu, podczas gdy zwolennicy MAGA sprzeciwiają się zmianom imigracyjnym.”

10 najlepszych miejsc na niezapomnianą przygodę narciarską

Odkryj 10 najlepszych destynacji narciarskich na świecie, oferujących zapierające dech w piersiach stoki, przytulne domki i niezapomniane zimowe przygody.

Pomysły na stylowe stroje damskie na Nowy Rok

Podnieś swój wygląd sylwestrowy dzięki tym stylowym pomysłom na strój dla kobiet, które idealnie łączą elegancję, blask i wygodę!

Trump’s Stance on H-1B Visas Sparks Debate

Trump supports H-1B visas, sparking debates. Elon Musk defends their impact, while MAGA loyalists push back against immigration shifts.”

Proste sposoby na elegancki styl zieleni

Opanuj sztukę stylizacji zieleni z wyrafinowaniem. Odkryj 10 prostych sposobów, aby bez wysiłku dodać elegancji do swojej garderoby.

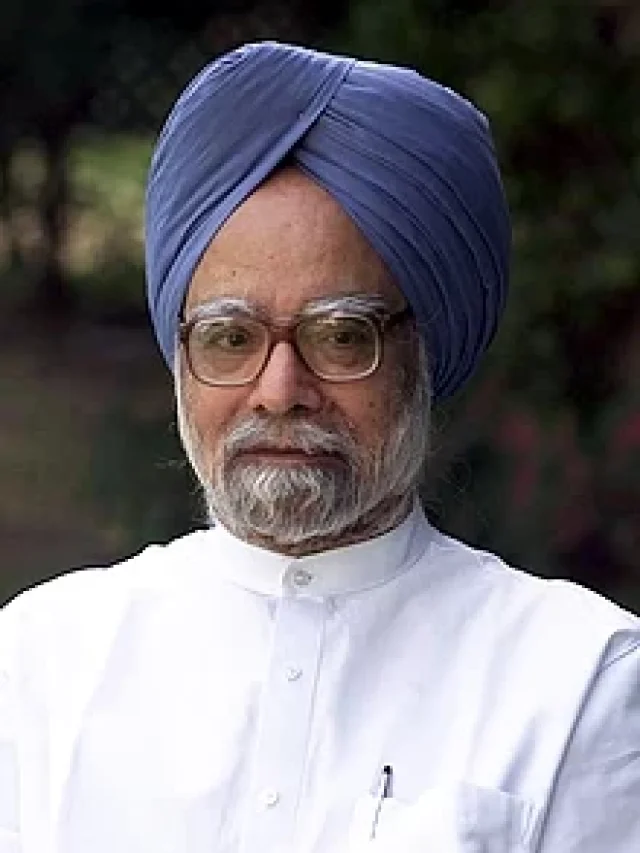

Highlights of Manmohan Singh’s Legacy

Manmohan Singh: A visionary leader who transformed India’s economy and politics with humility, wisdom, and dedication.

Top 10 Destinations for an Unforgettable Ski Adventure

Explore the world’s top 10 ski destinations offering breathtaking slopes, cozy chalets, and unforgettable winter adventures.

Stylish Women’s Outfit Ideas for New Year

Elevate your New Year’s Eve look with these stylish outfit ideas for women that blend elegance, glam, and comfort perfectly!

Effortless Ways to Style Green Elegantly

Master the art of styling green with sophistication. Discover 10 easy ways to add elegance to your wardrobe effortlessly

Najlepsze pokarmy na lęk i depresję

Wzmocnij dobre samopoczucie psychiczne dzięki pokarmom poprawiającym nastrój, takim jak tłuste ryby, orzechy i jagody, które łagodzą niepokój i zwalczają depresję.

Najlepsze miejsca do odwiedzenia w Darwin

Odkryj najlepsze miejsca w Darwin — od oszałamiających plaż po zabytki kulturalne i ekscytujące spotkania z dziką przyrodą.

Kreatywne i świąteczne drinki na Boże Narodzenie i Nowy Rok

Świętuj sezon z kreatywnymi drinkami — świątecznymi koktajlami, bezalkoholowymi drinkami i przytulnymi napojami na Boże Narodzenie i Nowy Rok.

Kanał Panamski: Historia, wyzwania i kontrowersyjne uwagi Trumpa

Dowiedz się więcej o historii Kanału Panamskiego, jego znaczeniu i dlaczego ostatnie komentarze Trumpa wywołują poruszenie.

Najlepsze męskie stroje na przyjęcia bożonarodzeniowe i noworoczne

Mężczyźni, opanujcie styl bożonarodzeniowy i noworoczny za pomocą smokingów, aksamitnych marynarek, kraciastych koszul i odważnych dodatków, aby uzyskać świąteczny charakter!

Ewolucja czerwono-białego stroju Świętego Mikołaja

Kultowy czerwony strój Świętego Mikołaja ewoluował na przestrzeni dziejów, łącząc nostalgię, sztukę i praktyczność w ukochany wizerunek, który znamy dzisiaj.

Best Places to Visit in Darwin

Discover Darwin’s best spots—from stunning beaches to cultural landmarks and thrilling wildlife encounters.

Creative and Festive Drinks to Celebrate Christmas and New Year

Celebrate the season with creative drinks—festive cocktails, mocktails, and cozy beverages for Christmas and New Year’s.

AI Error Fuels Steve Harvey Death Hoax

Steve Harvey’s death hoax, fueled by an AI error, spread false news, but the comedian remains active online, dispelling rumors.

Delhi’s Air Quality Crisis Amid Cold Wave

Delhi’s air quality hits hazardous levels amid a cold wave, causing severe pollution and disrupting daily life.

The Most Memorable Looks from The Fashion Awards 2024

The Fashion Awards 2024 showcased stunning red carpet looks from stars like Rihanna, A$AP Rocky, Issa Rae, and more.

Visa-Free Entry to Russia for Indian Tourists in 2025

Starting in 2025, Indian tourists can travel to Russia visa-free, making trips to Moscow, St.Petersburg, and beyond easier.

Explore the Best Christmas Markets in Europe This December

Discover Europe’s most magical Christmas markets this December, offering festive treats, local crafts, and enchanting holiday vibes.

Bezwizowy wjazd do Rosji dla turystów z Indii w 2025 r.

Począwszy od 2025 roku indyjscy turyści będą mogli podróżować do Rosji bez wizy, co ułatwi podróże do Moskwy, Petersburga i innych miejsc.

10 najlepszych ciast do upieczenia na obchody Bożego Narodzenia w 2024 roku

Rozkoszuj się świątecznym pieczeniem! 10 najlepszych ciast świątecznych na 2024 rok wnosi smaki i radość do każdej uroczystości. Odkryj swoje ulubione!

Najbardziej ukochane miasta świata do odwiedzenia w 2025 roku

Discover the world’s most lovable cities to visit in 2025, from Paris to Kyoto, offering culture, nature, and vibrant charm.

ZEA oferuje bezpłatne wizy rodzinne dla dzieci poniżej 18 roku życia

ZEA oferuje bezpłatne wizy rodzinne dla dzieci poniżej 18 roku życia w celu zwiększenia turystyki, dostępne za pośrednictwem zatwierdzonych agencji podróży.

Idealne zestawienia kolorów, które podkreślą Twój wygląd

Odkryj kombinacje kolorów, które wzbogacą Twój strój i podniosą Twój styl dzięki pięknym połączeniom do każdego wyglądu.

Fryzury świąteczne DIY na bezproblemowy, świąteczny wygląd

Stwórz szykowne, łatwe fryzury świąteczne przy minimalnym wysiłku. Idealne na świąteczne spotkania lub przytulny czas z rodziną.

Najlepsze jedzenie do spróbowania na Gold Coast

Odkryj najlepsze jedzenie do spróbowania w Gold Coast, od świeżych owoców morza po burgery gourmet i tropikalne desery!

Jak skarpetki mogą być zabawne i stylowe

Odkryj, jak skarpetki mogą być zarówno zabawne, jak i stylowe, od odważnych wzorów po przytulne skarpetki-kapcie, dodając polotu każdej stylizacji.

Top Places You Should Visit in Canberra

Discover Canberra’s charm with must-visit attractions like the War Memorial, Lake Burley Griffin, and vibrant Old Bus Depot Markets.

Top Foods to Try in Adelaide for Food Lovers

Explore Adelaide’s top food experiences, from Barossa Valley wine to Australian lamb and delicious local specialties.

DIY Holiday Hairstyles for Effortless Festive Looks

Create chic, easy holiday hairstyles with minimal effort. Perfect for festive gatherings or cozy family time.

Bitcoin przekracza 100 tys. dolarów w obliczu wzrostu rynku napędzanego kryptowalutami Trumpa

Bitcoin osiąga kamień milowy 100 000 USD dzięki polityce Trumpa opartej na kryptowalutach, co zapowiada nową erę aktywów cyfrowych pod jego rządami.

Best Food to Try in Gold Coast

Discover the best food to try in Gold Coast, from fresh seafood to gourmet burgers and tropical desserts!

10 magicznych europejskich miasteczek na przytulne Boże Narodzenie

Odkryj najlepsze miasta bożonarodzeniowe w Europie! Od świątecznego uroku Wiednia po magię Świętego Mikołaja w Rovaniemi, poczuj ducha świąt.

10 pomysłów na aksamitne stylizacje, które ulepszą Twoją zimową garderobę

Podnieś poziom swojej zimowej garderoby za pomocą aksamitu! Odkryj 10 szykownych pomysłów, aby pozostać stylowym i przytulnym w tym sezonie.

1,853 / 5,000 Najlepsze miejsca w Europie na przytulne zimowe wakacje

Odkryj najlepsze przytulne zimowe wypady w Europie, od zaśnieżonych wiosek po świąteczne miasta i alpejskie schroniska.

How Socks Can Be Fun and Stylish

Explore how socks can be both fun and stylish, from bold patterns to cozy slipper socks, adding flair to any outfit.

Bitcoin Crosses $100K Amid Trump’s Crypto-Driven Market Surge

Bitcoin hits $100K milestone on Trump’s crypto-fueled policies, signaling a new era for digital assets under his administration.

Stan wojenny odwołany w Korei Południowej

Korea Południowa cofa stan wojenny po niespodziewanym dekrecie prezydenta Yoona, powodując chaos polityczny i niepokoje społeczne.

Najbardziej pamiętne stylizacje z The Fashion Awards 2024

Na rozdaniu nagród Fashion Awards 2024 zaprezentowano oszałamiające kreacje na czerwony dywan takich gwiazd jak Rihanna, A$AP Rocky, Issa Rae i wiele innych.

Wirusowy występ Dave’a Bluntsa i kontrowersje wokół Snoop Dogga

Tribute Dave’a Bluntsa dla Juice WRLD wywołuje obawy dotyczące zdrowia, sprzeciw wobec wyboru piosenki i zaciekłą waśń ze Snoop Doggiem.

Is Disney Channel Shutting Down?

Rumors claim Disney Channel is shutting down worldwide, but Disney confirms it remains active in North America despite changes elsewhere.

Dua Lipa’s ‘Levitating x Woh Ladki Jo’ Mashup Controversy

Dua Lipa’s mashup of Levitating x Woh Ladki Jo sparks a credit controversy involving Abhijeet Bhattacharya and Anu Malik.

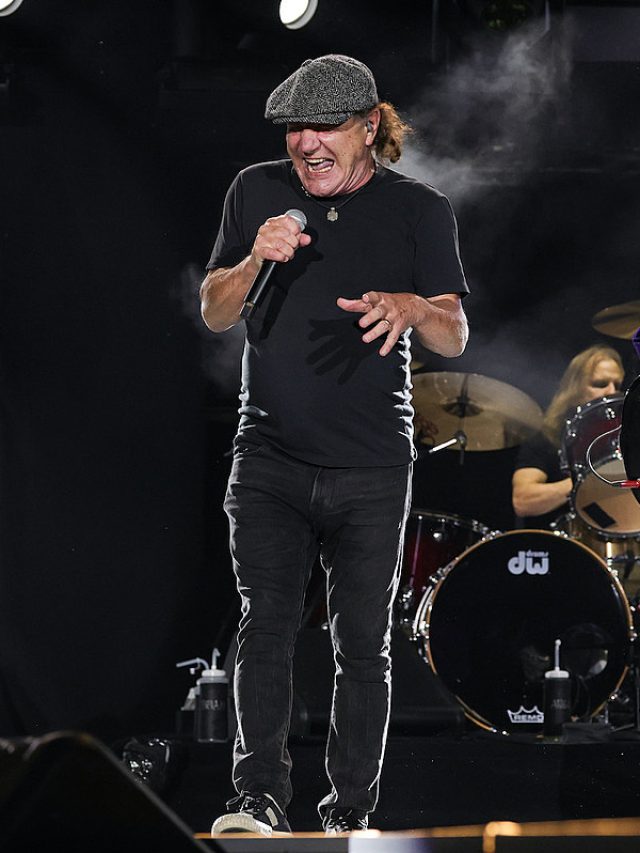

AC/DC wraca na Ford Field w Detroit w 2025 roku

Legendy rocka AC/DC powracają z trasą „Power Up Tour”, występując na Ford Field w Detroit 30 kwietnia 2025 r.

Czy Disney Channel zostanie zamknięty?

Plotki głoszą, że Disney Channel zostanie zamknięty na całym świecie, ale Disney potwierdza, że kanał pozostaje aktywny w Ameryce Północnej pomimo zmian w innych miejscach.

Najlepsze miejsca, które warto odwiedzić w Canberze

Odkryj urok Canberry dzięki obowiązkowym atrakcjom, takim jak War Memorial, Lake Burley Griffin i tętniące życiem Old Bus Depot Markets.

Najlepsze potrawy do spróbowania w Adelajdzie dla miłośników jedzenia

Odkryj najlepsze doświadczenia kulinarne w Adelajdzie, od wina z Barossa Valley po australijską jagnięcinę i pyszne lokalne specjały.

Farmers’ March: Noida to Delhi Protests – Key Updates

UP farmers march to Delhi over compensation demands, causing route diversions, security checks, and traffic disruptions.

Odkryj najlepsze jarmarki bożonarodzeniowe w Europie w grudniu

Odkryj najbardziej magiczne jarmarki bożonarodzeniowe w Europie w tym grudniu, oferujące świąteczne smakołyki, lokalne rzemiosło i czarujące świąteczne klimaty.

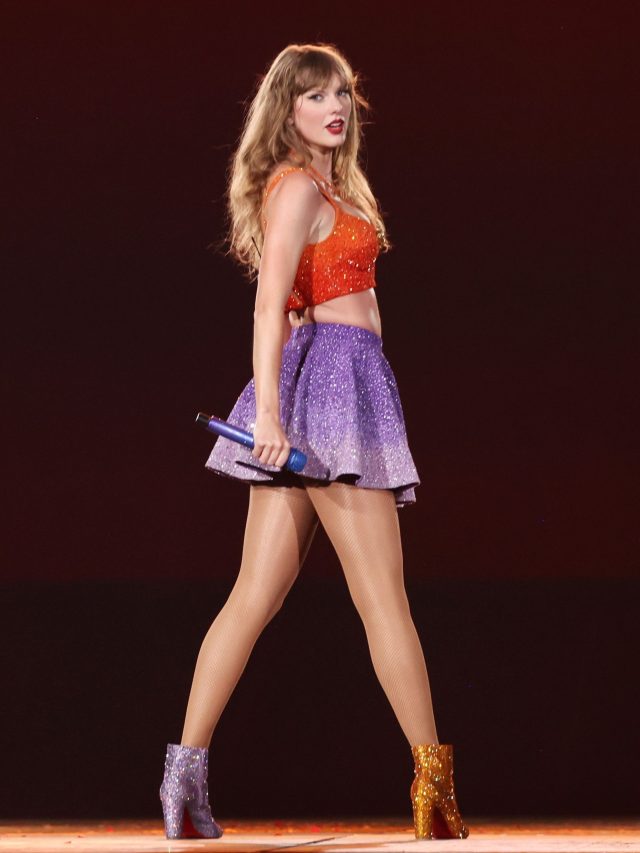

Taylor Swift’s The Eras Tour 2024: Vancouver Highlights

Taylor Swift’s The Eras Tour 2024 hits Vancouver for three shows with Gracie Abrams. Fans can’t miss this epic musical event!

Trasa koncertowa Taylor Swift The Eras 2024: najważniejsze wydarzenia w Vancouver

Trasa koncertowa Eras 2024 Taylor Swift zawita do Vancouver na trzy koncerty z Gracie Abrams. Fani nie mogą przegapić tego epickiego wydarzenia muzycznego!

Jak stylizować żółte ubrania z pewnością siebie

Żółty dodaje energii każdemu strojowi. Od monochromatycznych stylizacji po łączenie z neutralnymi kolorami, oto jak stylizować ten wyrazisty kolor.

How to Style Yellow Clothes with Confidence

Yellow adds energy to any outfit. From monochrome looks to pairing with neutrals, here’s how to style this bold color.

Australia’s World-First Social Media Ban for Under-16s

Australia passed a world-first law banning social media for under-16s, with tech companies facing fines if violated.

Pierwszy na świecie zakaz korzystania z mediów społecznościowych dla osób poniżej 16 roku życia w Australii

Australia uchwaliła pierwsze na świecie prawo zakazujące korzystania z mediów społecznościowych osobom poniżej 16. roku życia, a firmy technologiczne będą musiały płacić grzywny w przypadku naruszenia

Członkowie rodziny Donalda Trumpa wywierający wpływ wykraczający poza nazwisko Trump

Rodzina Donalda Trumpa nadal wpływa na Stany Zjednoczone poprzez służbę publiczną i rodzinne przedsiębiorstwa, a każdy członek wytycza swoją własną ścieżkę.

Unlock Black Friday 2024 Savings with DHgate Deals

Explore DHgate’s Black Friday Sale 2024! Huge savings, fast shipping, exclusive coupons & secure shopping worldwide.

Save Big This Black Friday Sale 2024 with Temu Deals!

Explore Temu’s Black Friday Sale 2024 and save up to 90% with amazing deals, flash sales, and fast delivery from local warehouses!

Ponadczasowe buty damskie, które pozostają stylowe i pasują na każdą okazję

Te ponadczasowe buty damskie oferują idealne połączenie stylu i wszechstronności, dzięki czemu pozostają modne i sprawdzają się na każdą okazję.

Thanksgiving 2024: Stores Open and Closed for Last-Minute Needs

Thanksgiving 2024 has limited store hours. Some grocery stores are open, but most big retailers like Walmart stay closed.

Mukul Rohatgi, Mahesh Jethmalani Address Adani Bribery Allegations

Adani Group denies bribery charges; Rohatgi, and Jethmalani criticize evidence, opposition’s politicization, and DOJ motives.

Domniemany skandal korupcyjny Adaniego: ujawniamy skutki

Adani stoi w obliczu amerykańskich zarzutów przekupstwa, ryzykując swoją spuściznę jako indyjskiego miliardera-potentata pośród ogromnych skutków finansowych i prawnych.

Wyzwania prawne USA wobec Gautama Adaniego

Gautam Adani stoi w obliczu amerykańskich zarzutów przekupstwa i oszustwa, ryzykując ekstradycję, długi proces i do 20 lat więzienia.

Plan Australii zakazu korzystania z mediów społecznościowych osobom poniżej 16 roku życia

Australia rozważa zakaz korzystania z mediów społecznościowych osobom poniżej 16 roku życia, mając na celu zwiększenie bezpieczeństwa online. Czy inne kraje pójdą w jej ślady?

Explore Vevor for Black Friday Sale 2024 to Get Up To 50% Off

Explore Vevor’s Black Friday 2024 sale with up to 50% off from November 18-29. Grab amazing deals across all categories!

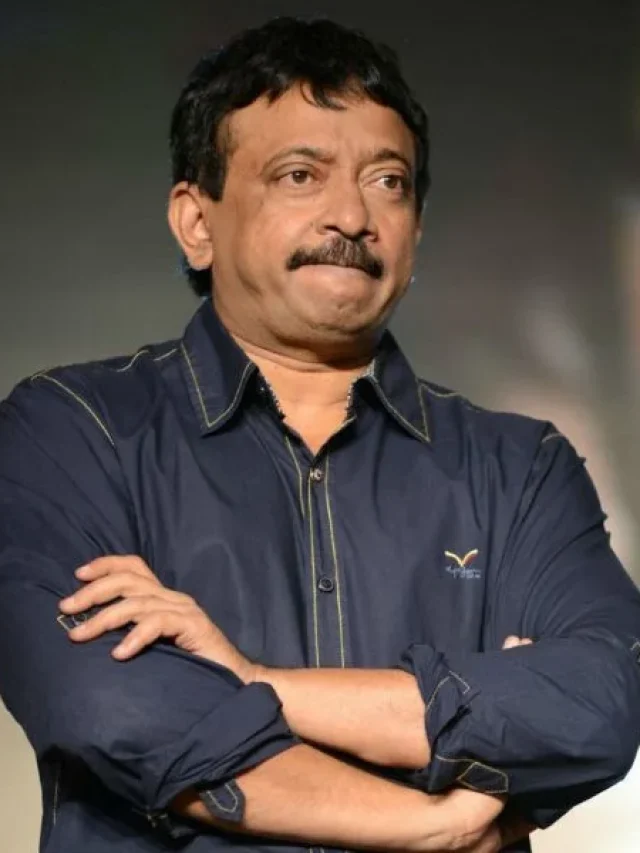

Ram Gopal Varma Missing: Police Hunt Across States

Andhra Pradesh Police hunt Ram Gopal Varma across states after he missed summons for investigation over offensive posts.

Australia’s Plan to Ban Social Media for Under-16s

Australia considers banning under-16s from social media, aiming to enhance online safety. Will other countries follow suit?

What Are Low-Glycemic Index (GI) Fruits and Why Are They Important for Your Health?

Low-GI fruits like berries, apples, and cherries are great for steady energy, diabetes management, and heart health.

AR Rahman and Saira Banu: Separation Marked by Mutual Respect

AR Rahman and Saira Banu separate after 29 years, citing health reasons. Both emphasize respect, trust, and mutual support.

Black Friday 2024: What to Expect

Get ready for Black Friday 2024 on November 29! Shop massive discounts at Vevor, Temu, DHgate, Tesco Mobile, and Luxury Escapes.

Marvel’s Upcoming Movie – Captain America: Brave New World

Marvel’s Captain America: Brave New World debuts Feb 14, 2025! Witness Sam Wilson’s epic journey as the new Cap.

Adani’s Alleged Bribery Scandal: Unveiling the Fallout

Adani faces U.S. bribery charges, risking his legacy as India’s billionaire tycoon amid massive financial and legal fallout.

U.S. Legal Challenges Against Gautam Adani

Gautam Adani faces U.S. charges of bribery and fraud, risking extradition, a lengthy trial, and up to 20 years in prison.

Top Leather Sneakers: Perfect Casual-Cool Style

Upgrade your casual-cool game with the perfect leather sneakers. Explore classic, trendy, and sustainable styles for every vibe!

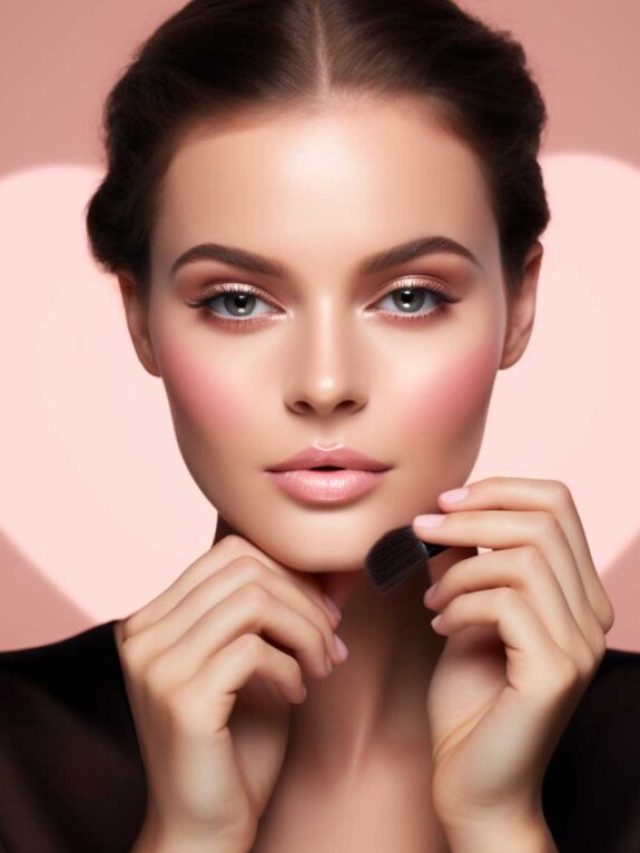

Blush Application Tips: Perfecting Your Look by Face Shape

Master blush application tailored to your face shape for a flawless look. Discover the perfect glow with Funandflip!

Must-Try Food in India: A Culinary Adventure Awaits!

Embark on an Indian gastronomic journey with these must-try dishes, from street food to royal delicacies.

Over 40 Hong Kong Pro-Democracy Figures Sentenced to Prison Under National Security Law

Over 40 Hong Kong pro-democracy leaders sentenced to up to 10 years in prison under the National Security Law.

The Game Awards 2024 Nominees Unveiled!

The Game Awards 2024 nominees are here! Discover the top games, including GOTY contenders like Astro Bot and Final Fantasy VII Rebirth.

Best Places to Visit in Hobart: Tasmania’s Gem

Explore the best places to visit in Hobart to enjoy culture, history, and natural wonders in a single visit!

John Krasinski Crowned 2024’s Sexiest Man Alive by People Magazine

John Krasinski wins 2024’s Sexiest Man Alive title, mixing comedy and charm, making fans and wife Emily Blunt proud.

Magnetic Nail Looks for Scorpio Season

Scorpio season calls for dark, bold nails with metallic accents, ombre gradients, and mystic designs to match the sign’s power.

Explore Lamoda: Top Fashion, Beauty, and Exclusive Deals for Trendsetters

Lamoda offers top fashion, footwear, beauty, and more, with seasonal discounts, exclusive collections, and easy returns!

How to Style in Yellow: A Guide to Wearing the Bold Color with Confidence

Learn how to style yellow with confidence! From neutral pairings to bold monochrome looks, yellow adds energy to your wardrobe.

Key Picks in President-elect Donald Trump’s Administration

Trump’s administration comprises seasoned professionals from military, political, and legal fields, promising a mix of national security, diplomacy, and regulatory reforms.

Donald Trump Family Members Making an Impact Beyond the Trump Name

Donald Trump’s family continues to influence the U.S. through public service and family businesses, each member carving their unique path.

Must-Try Foods in Malaysia for an Authentic Culinary Experience

Explore Malaysia through its iconic dishes—from spicy noodles to refreshing desserts—each bite tells a story of cultural fusion.

Priyanka Chopra’s Anomaly Haircare: What Sets It Apart?

Priyanka Chopra’s Anomaly Haircare stands out with clean ingredients, sustainability, affordability, and a global, inclusive vision.

Gold Coast: Top Spots to Discover

Explore the Gold Coast’s best: from scenic beaches and thrilling theme parks to lush national parks and wildlife sanctuaries.

Megan Fox and Machine Gun Kelly: Baby No. 4 on the Way!

Megan Fox and Machine Gun Kelly are expecting their first baby together, marking a new chapter in their shared journey.

Fruits You Must Avoid If You Have High Blood Sugar

Manage your blood sugar by avoiding high-sugar fruits like mangoes, grapes, and pineapples. Try low-GI options instead.

Best Latest Comedy Movies from Hollywood to Watch

Discover 2023’s top comedy films, from Barbie to Strays, bringing fresh laughs to every taste in Hollywood!

Must-Try Food in Laos: A Culinary Exploration

Discover Laos through its unforgettable dishes, from spicy larb to crispy rice salad. A must-try list for every food lover!

Perfect Gift Ideas for Men: Thoughtful and Appropriate Choices That Make an Impact

Discover meaningful, practical gifts for men that suit every personality, from classy accessories to unforgettable experiences.

Celebrity Reactions to the 2024 U.S. Election: Emotions Run High After Trump’s Victory

From Ariana Grande’s heartfelt message to Dave Portnoy’s praise, celebrity reactions capture the diverse emotional responses to Trump’s return to the White House.

What is the 4B Movement and Why is it Gaining Attention?

The 4B movement’s resurgence following the U.S. election shows a growing demand for dialogue around women’s independence and societal expectations globally.

Orange Outfit Ideas: Style Guide for Every Occasion

Wearing orange can be both bold and stylish when done right. Experiment with shades and pairings to create standout looks effortlessly.

High-Protein Fruits for Weight Loss: Nature’s Tasty Boost

High-protein fruits like guava, avocado, and blackberries support weight loss by keeping you full, energized, and promoting metabolism.

Discover Adelaide: 10 Must-See Spots for Every Explorer

Adelaide is a blend of nature, art, and culture, with attractions from stunning beaches to vibrant markets.

Expedia Unveils Exceptional Travel Deals for Every Adventurer!

Expedia, Asia’s fast-growing travel portal, offers competitive rates on hotels, flights, and activities, ensuring personalized travel experiences. Enjoy rewards and save on your next adventure!

Race to 270: Harris and Trump in a Nail-Biting Battle for the White House

With tight competition in swing states, each candidate focuses on securing critical votes for a 270 majority win.

Nature’s Most Surreal and Mysterious Formations Across the World

Explore nature’s bizarre beauty with these surreal landscapes, each a testament to Earth’s remarkable forces.

Best Yoga Asanas for Daily Health & Wellbeing

Achieve daily health benefits with these 10 essential yoga asanas that support physical flexibility, mental focus, and relaxation.

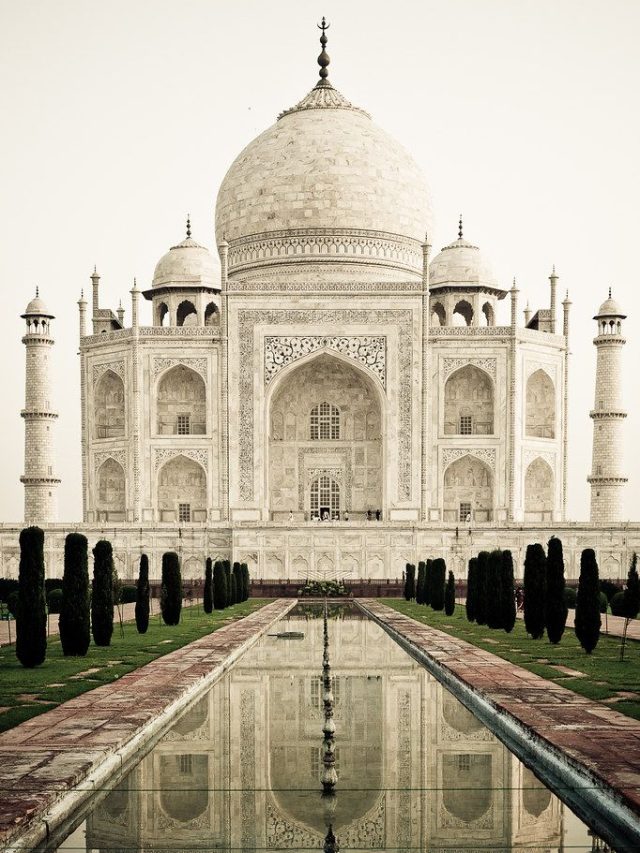

Top 10 Must-Visit Destinations in India for Unforgettable Adventures

Discover India’s best destinations from palaces in Jaipur to the serene backwaters of Kerala for a memorable journey.

Top 10 Luxurious Trains in the World

These iconic trains offer more than just transportation—they’re journeys filled with splendor, adventure, and unforgettable memories.

Trendy Eye Makeup Ideas for a Stunning Look

Explore trendy eye makeup ideas, from bold liners to shimmery lids, for a look that’s both stylish and standout this season.

Natural Alternatives to Sugar for Healthier Sweetening

Discover 10 natural alternatives to sugar that offer sweetness with added health benefits—perfect for a healthier diet.

Morrisons UK: Freshness and Quality at the Heart of Every Shopping Trip

Morrisons UK combines quality and value with fresh products, competitive prices, and community-focused services for a premium shopping experience.

Best Places to Visit in Malaysia: Explore the Wonders of Southeast Asia

These destinations showcase Malaysia’s blend of modernity, culture, and natural beauty, offering memorable experiences for all travelers.

Must-Try Sri Lankan Delicacies: A Taste of Island Flavors

Discover Sri Lanka’s rich culinary heritage through its most iconic dishes, from Kottu Roti to Watalappam, a flavorful journey.

How to Style Blue with Confidence and Ease

Learn how to style blue with confidence using textures, patterns, and color combos that bring out the best in every shade.

Refreshing and Healthy Drinks to Lift Your Mood and Brighten Your Day

Discover a variety of healthy drinks designed to elevate your mood and keep you refreshed. From herbal teas to superfood smoothies, these drinks are perfect pick-me-ups!

Trendy Jewelry Pieces to Elevate Your Style

Add these trendy pieces to elevate your accessory game and express your unique style!

Top Global Destinations You Must Visit in 2025 for Unforgettable Experiences

Discover the top travel destinations for 2025, from the vibrant streets of Toulouse to the serene beaches of Pondicherry, and more. Each city offers a unique experience.

Alia Bhatt Opens Up About ADHD: Understanding the Condition

Alia Bhatt’s ADHD journey sheds light on this condition, highlighting the challenges and importance of understanding and managing it effectively.

Top Must-Visit Travel Destinations in Laos for an Unforgettable Experience

Laos is a land of natural beauty, cultural heritage, and adventure. From ancient temples to stunning waterfalls, these destinations offer a unique travel experience.

Best Breakfasts to Stay Energetic All Day

Starting your day with these balanced, nutrient-dense breakfasts will help sustain energy levels and keep you feeling vibrant and productive.

Timeless Women’s Shoes That Stay in Style and Suit Any Occasion

These timeless women’s shoes offer the perfect combination of style and versatility, ensuring they stay in trend and work for any occasion.

Must-Try Traditional Dishes in the Philippines

From savory stews to refreshing desserts, Filipino cuisine offers a delightful variety of must-try dishes, reflecting the rich cultural diversity of the Philippines.

LeBron and Bronny James Make NBA History

LeBron and Bronny James etched their names into NBA history, joining a select few father-son duos to play together in major American sports.

Explore the World’s Best Museums to Visit

From the grandeur of the Louvre to the modernity of MoMA, these museums offer a glimpse into the world’s artistic and historical treasures, making them must-visit destinations for art lovers.

Iconic Luxury Watches Every Man Should Own

From Rolex to Hublot, these luxury watches combine style, sophistication, and precision, perfect for men who value craftsmanship.

Top Destinations You Must Visit in Nepal

Explore Nepal’s rich culture, breathtaking landscapes, and spiritual sites, from the bustling streets of Kathmandu to the majestic Mount Everest Base Camp.

Did You Know? Bella Hadid Owns a Skin-Nourishing Perfume Line – Orebella

Do you know Bella Hadid owns a skin-nourishing perfume line called Orebella? Featuring vegan, cruelty-free, mood-boosting scents with a unique bi-phase formula.

How to Dress in Red: Bold and Elegant Styling Tips

Master the art of dressing in red by selecting the right shade, pairing with neutrals, and accessorizing thoughtfully for a bold, elegant look.

International Stars Who Own Whiskey Brands: A Blend of Fame and Flavor

Celebrities like David Beckham and Matthew McConaughey are not just stars—they’re also whiskey moguls, blending fame with premium spirits in iconic whiskey brands.

Best Places to Visit in the Philippines

The Philippines offers a diverse array of breathtaking sights, from natural wonders to historical landmarks, perfect for every traveler. Explore the beauty and culture of this tropical paradise!

The Most Expensive Hotels in the World

These extravagant hotels redefine luxury, offering unique experiences and opulent accommodations for travelers seeking the ultimate indulgence. Treat yourself to the world’s finest!

Festival Season in India: Discover the Different Types of Traditional Sarees

Indian traditional sarees offer a rich cultural heritage.From Banarasi to Patola, explore the beautiful sarees perfect for the festive season.

![Early Sunrise Pancakes [30 Minutes]](https://visualstories.funandflip.com/wp-content/uploads/2024/10/cropped-Early-Sunrise-Pancakes-30-Minutes.jpg)

Must-Try Foods in Indonesia: A Flavorsome Experience

Indonesian cuisine offers a rich variety of flavors and textures, from savory street foods to hearty, traditional dishes that reflect the nation’s diverse culture.

Games to Boost Your IQ and Sharpen Your Mind

These games offer a fun and effective way to enhance your IQ, strengthen memory, and boost overall cognitive abilities.

Most Luxurious Cars for a Life of Elegance and Style

These luxurious cars combine elegance, craftsmanship, and performance, offering an unmatched experience for those who desire a luxury lifestyle.

How to Style in Brown: A Fashion Guide

By incorporating these tips, you can effortlessly style brown in your wardrobe, creating a variety of chic looks suitable for any occasion.

Must-Try Cuisines in Dubai: A Culinary Journey Across Cultures

Dubai’s culinary scene blends global influences and local tradition, offering dishes like shawarma and luqaimat, making it a must-visit destination for food lovers.

Clean Eating: Simple Ways to Detox Your Diet for a Healthier You

Detoxing your diet is as simple as focusing on whole foods, drinking water, and cutting out processed ingredients for a healthier lifestyle.

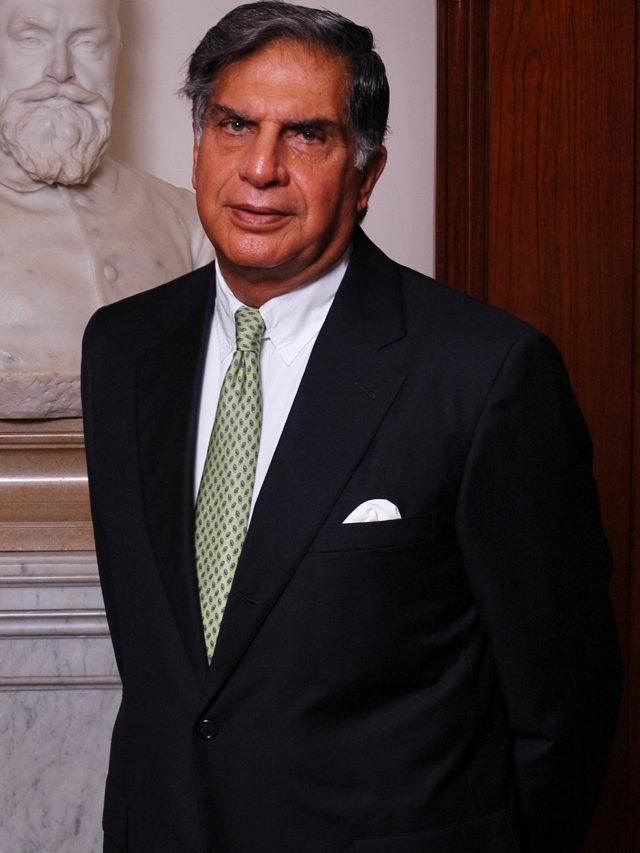

Bid Adieu to Ratan Tata: A Farewell to a Visionary Leader

Ratan Tata, visionary industrialist and honorary chairman of Tata Sons, has passed away at 86. He will be laid to rest with state honors at Mumbai’s Worli crematorium today.

Must-See Sights in Vietnam: A Journey Through Beauty and Culture

Vietnam offers an incredible blend of natural beauty and rich cultural history. From Ha Long Bay to the Golden Bridge, its iconic landmarks are a must-visit for every traveler.

The World’s Most Luxurious Bags: Icons of Wealth and Timeless Style

These luxurious bags have redefined fashion with their iconic designs and impeccable craftsmanship. From Hermès to Bvlgari, they are symbols of elegance and status.

How to Style in White: Effortless Elegance and Timeless Appeal

White is a versatile and timeless color that can be styled in numerous ways. Whether casual or formal, it effortlessly enhances any wardrobe.

The Most Popular Street Food You Must Try When You Visit India

Indian street food is a culinary adventure, from the spicy Vada Pav of Mumbai to the tangy Pani Puri enjoyed across the country. Each bite is a celebration of flavors.

The Most Creepy Movie Characters Since 2000

Since 2000, horror cinema has introduced new, spine-chilling characters like Pennywise and Jigsaw, who have haunted audiences with their terrifying presence and disturbing actions.

Get ready for the festive season with stylist-approved holiday outfits. From sequins to statement coats, these trends will keep you chic and cozy.

Get ready for the festive season with stylist-approved holiday outfits. From sequins to statement coats, these trends will keep you chic and cozy.

Transforming Nails into Art: The Sculptural Revolution in Nail Design

Sculptural nail art is revolutionizing how we perceive manicures, with artists pushing creative boundaries through innovative techniques and unique materials. Each design is a testament to individual

Discover the Best Must-Visit Spots in Antarctica

Antarctica offers a range of breathtaking locations for nature lovers and adventure seekers alike. From stunning landscapes to unique wildlife, the continent is a treasure trove waiting to explored

Gaurav Taneja and Ritu Rathee Divorce Rumors: The Viral Buzz Around the YouTuber Couple

Rumors about Gaurav Taneja and Ritu Rathee’s divorce have taken social media by storm, with fans eagerly waiting for confirmation.

Top 10 Living Fashion Designers Shaping Global Style

These living fashion designers continue to shape and innovate the fashion world, blending tradition with bold new ideas, and influencing global style.

Affordable Destinations in South America to Explore

Explore South America’s most beautiful yet affordable destinations, where culture, nature, and adventure meet without breaking the bank. Discover vibrant cities, breathtaking landscapes, and history.

Discover Australia’s Best Affordable Travel Destinations

Explore the hidden gems of Australia that offer unforgettable experiences without breaking the bank. Affordable adventures await!

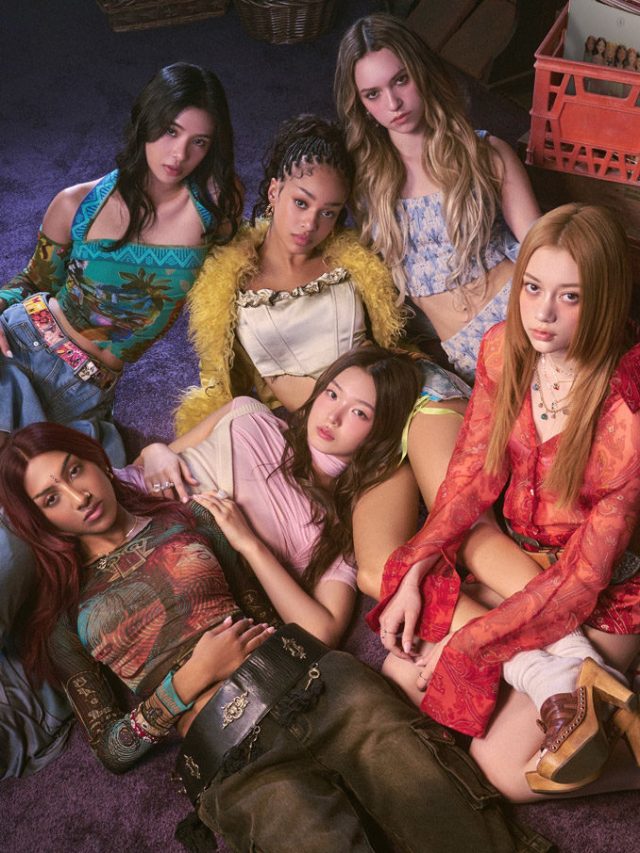

KATSEYE: The Rising Global Girl Group

KATSEYE is gaining fame for its innovative approach to fashion, blending cutting-edge design with unique artistic talent. Their bold vision is redefining trends and captivating the fashion world.

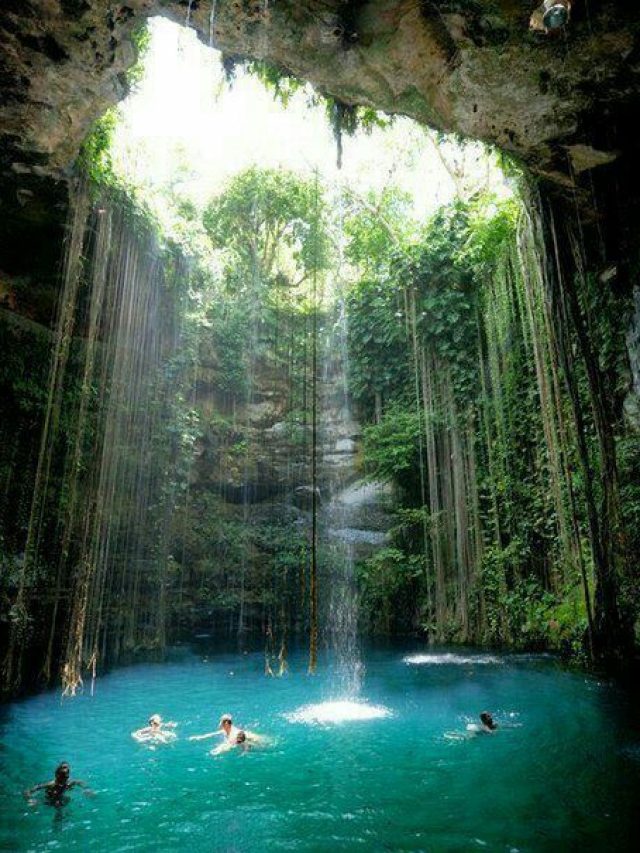

Obsessed with Traveling? Discover Nature’s Most Magical Wonders Before You Die!

These breathtaking destinations offer some of the most magical and unforgettable experiences of a lifetime!

Budget-Friendly Beauty: Must-Visit Cities in North America

From historic cities to vibrant cultural hubs, these North American destinations prove you don’t need to break the bank to experience beauty and adventure.

Trendy Eyebrow Styles You Should Keep an Eye On for the Upcoming Seasons

Discover the eyebrow trends set to dominate in 2025, from natural fullness to bold colored brows. Get ready for some serious brow inspiration!

Top Affordable Cities to Visit in Africa: Explore Under Budget

Discover the most affordable cities in Africa where you can explore rich culture, stunning landscapes, and unforgettable experiences—all under budget. Perfect for travelers seeking adventure without b

Weirdest Buildings in the World: Architectural Marvels or Oddities?

These buildings are a testament to the creativity of architects around the world, where functionality meets the extraordinary!

Beautiful Yet Affordable: The Best Asian Countries to Visit

These Asian countries offer breathtaking beauty and rich cultural experiences without breaking the bank, perfect for budget-conscious travelers.

Must-Know Gen Z Fashion Trends That Are Taking Over

Explore the bold and dynamic fashion trends defining Gen Z, from oversized fits to sustainable styles, shaping today’s fashion world.

Cheapest European Countries to Visit: A Visual Guide

Exploring Europe doesn’t have to break the bank! These European countries offer affordable travel experiences without compromising on charm and adventure.

International Celebrities Who Own Makeup Brands: Transforming the Beauty Industry

Celebrities have successfully ventured into the beauty industry, creating makeup brands that blend personal style with innovation. From Rihanna’s inclusive Fenty Beauty to Selena Gomez’s Rare Beauty,

The Most Expensive Properties in the World: The Pinnacle of Luxury Living

From royal palaces to billionaire mansions, these are the world’s most expensive properties, showcasing opulence, luxury, and architectural grandeur.

Celebrity Hair Colors That Shaped Trends Globally: What to Pick for Your Next Look

From platinum blonde to fiery red, celebrities worldwide are setting bold hair color trends, inspiring your next salon visit.

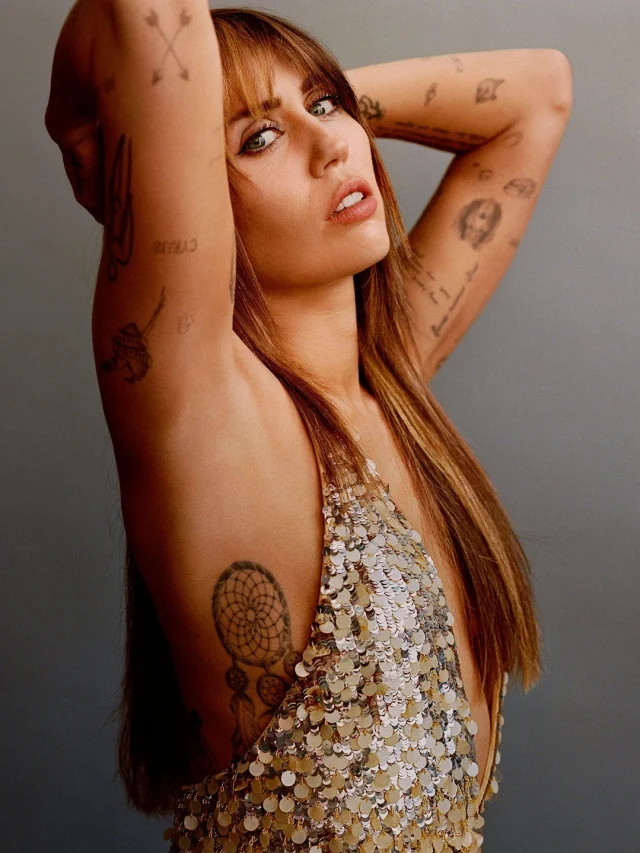

Must-See Celebrity Tattoos for Your Next Ink Inspiration

These celebrity tattoos are more than just body art; they carry personal meanings and stories. Find inspiration for your next ink appointment with these standout designs!

76th Emmys Red Carpet: A Spectacular Night of Glamour and Triumph

The 76th Emmys are a spectacular display of television excellence and red carpet fashion, honoring the best in the industry with style and flair.

Best Bedtime Drinks for a Peaceful Sleep

Discover 10 calming bedtime drinks, from warm milk to chamomile tea, that can help you relax and sleep better.

Sri Lanka Offers Visa-Free Access to 34 Countries, Including India, Starting October 2024

With visa-free entry, Sri Lanka invites Indian travelers to discover its beauty, culture, and hospitality without any travel restrictions!

Boldest Fashion Moments at the 2024 MTV VMAs: Stars Slayed the Carpet

These stars pushed the boundaries of red-carpet fashion, delivering some of the most unforgettable looks at the 2024 MTV VMAs.

Ariana’s Iconic Music Career: The Road to Wicked

Ariana Grande’s journey from Nickelodeon star to Grammy-winning pop icon, now starring in Wicked, showcases her unstoppable talent.

Luxury in a Glass: The 10 Most Expensive Liquors That Redefine Extravagance

Explore the world’s 10 most expensive liquors, from diamond-encrusted bottles to rare aged spirits, showcasing ultimate luxury.

TEMU: The Rise of a Global E-Commerce Powerhouse

TEMU is a global e-commerce platform offering affordable products, user-friendly features, and fast shipping, connecting buyers worldwide.

Cultural Fashion Fusion: Blending Traditional and Modern Styles

Designers blend traditional garments with modern styles, creating stunning cross-cultural fashion fusions that celebrate heritage and contemporary trends.

High-Protein Fruits for Weight Loss: Nature’s Tasty Boost

High-protein fruits like guava, avocado, and blackberries support weight loss by keeping you full, energized, and promoting metabolism.

The Dance Craze: A Journey Through Dance Trends and Their Impact on Culture

Explore the evolution of dance trends, from ballroom to TikTok, and their lasting impact on global popular culture.

High-End Fashion and Lifestyle: Embrace the Elegance

High-end fashion combines luxury, craftsmanship, and timeless style, offering exclusive pieces and experiences that elevate your confidence and lifestyle.

Nutrient-Dense Superfoods to Eat Every Day

Incorporate these nutrient-dense superfoods—like leafy greens, berries, nuts, and salmon—into your daily diet for optimal health and wellness.

The Role of Social Care: Nurturing Communities and Enhancing Lives

Social care enhances lives by providing vital support services, empowering individuals, strengthening communities, and adapting to future needs with innovation.

Most Expensive Perfumes in the World: A Journey of Luxury and Elegance

Explore the world’s most expensive perfumes, featuring rare ingredients, exquisite craftsmanship, and unparalleled luxury, reserved for true connoisseurs.

Green Revolution: How Plant-Based Innovations Are Shaping the Future

The visual story highlights the growing popularity and diversity of plant-based products, from supermarkets to high-end restaurants and even fitness studios.

Azerbaijan: Fire, Ice, and All Things Nice

Azerbaijan: Explore Baku’s Walled City, which UNESCO has designated as a World Heritage site.

MAC Cosmetics, founded to serve makeup professionals

MAC Cosmetics, founded to serve makeup professionals, has grown into a globally recognized brand known for its innovative products and commitment to diversity.

Details and pricing for the 2025 Mercedes-Benz V-Class

Mercedes-Benz in 2025 continues to lead the automotive industry with a focus on sustainability, innovation, and luxury. As part of its strategic vision.

Fashion is a dynamic and ever-evolving industry

Fashion is an ever-evolving medium that reflects individuality and cultural identity while following the latest trends and advances. It includes decisions for attire, accoutrements.

Nail art has become a popular trend

Nail art has become a popular trend, offering endless creativity and expression. In 2023, several standout designs emerged, such as monochrome looks inspired by yin-yang.

Easy strategies to prepare yourself for a successful workout

A good night’s sleep is essential for optimal workout performance. It aids in recovery, boosts energy levels, and enhances focus. Lack of sleep can negatively impact your gym performance

Delay in hearing regarding Olympic disqualification

Vinesh Phogat is an accomplished Indian wrestler who has made significant contributions to the sport, with multiple international victories. Her career is marked by resilience and determination

Neeraj Chopra wins silver

Neeraj Chopra threw 1.87m farther than his Tokyo Olympic gold-winning throw, but in Paris, he secured silver as Arshad Nadeem made history for Pakistan with an Olympic record throw of 92.97m, crossing

The Eiffel Tower in Medals

The Paris 2024 Olympic medals incorporate a piece of the Eiffel Tower, designed with athlete input and crafted by Chaumet. The medals feature a hexagon shape, radiant lines.

2024: Badminton in Paris

The largest event to be hosted in France will be the Olympic and Paralympic Games in Paris in 2024. From July 26 to August 11, 2024, Paris will host the Olympic Games

Lionel Messi celebrated Copa América game.

Argentinean professional football player Lionel Andrés “Leo” Messi captains and plays forward for both the Argentina national team and Major League Soccer Club Inter Miami.

Best-Dressed at the 2022 Met Gala

The aforementioned theme gave rise to numerous remarkable fashion moments, such as Kim Kardashian donning the most iconic dress of Marilyn Monroe, Blake Lively revealing her second dress while walking

The world’s ten least livable cities as of 2023

In 2023, various factors such as political instability, economic challenges, poor infrastructure, and lack of access to healthcare and education contribute to making certain cities the least liveable

Announcements and updates regarding the schedule of T20 tournaments

India, the epitome of cricketing prowess, triumphed in the T20I World Cup with unmatched finesse and determination